Calculate the depreciable cost of the equipment on january 1 – Calculate the depreciable cost of equipment on January 1 is a critical step in accounting for fixed assets. It establishes the portion of an asset’s cost that can be expensed over its useful life, reducing taxable income and providing a more accurate representation of a company’s financial position.

This guide provides a comprehensive overview of the process, including determining acquisition cost, establishing useful life, calculating depreciable cost, and applying depreciation methods. By understanding these concepts, businesses can ensure accurate financial reporting and optimize their tax strategies.

1. Determine the Equipment’s Acquisition Cost

The acquisition cost of an equipment is the total cost incurred to acquire and prepare the equipment for its intended use. It includes not only the purchase price but also any additional costs necessary to make the equipment operational.

Examples of expenses included in the acquisition cost are:

- Purchase price

- Shipping and handling charges

- Installation costs

- Training costs

- Testing and inspection costs

The acquisition cost can be calculated using various methods, such as:

- Invoice method: The acquisition cost is determined based on the invoice price of the equipment.

- Cost method: The acquisition cost includes all costs incurred to acquire and prepare the equipment for use, including shipping, handling, installation, and training costs.

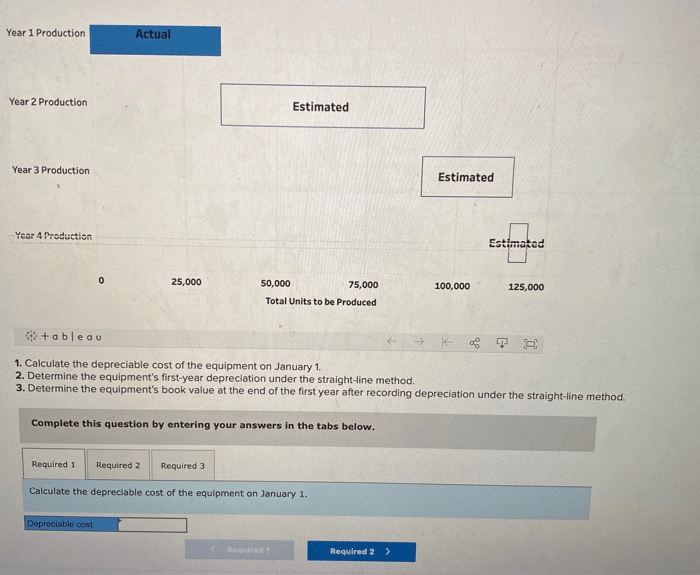

2. Establish the Equipment’s Useful Life

The useful life of an equipment refers to the period over which the equipment is expected to be used and generate economic benefits for the business. It is an estimate based on various factors and can be determined using different methods.

Methods for determining the useful life of equipment include:

- Manufacturer’s estimates: Many manufacturers provide estimates of the useful life of their equipment based on industry standards and historical data.

- Historical data: Businesses can refer to their own historical data on the useful life of similar equipment.

- Industry benchmarks: Industry associations and publications often provide benchmarks for the useful life of different types of equipment.

Factors that can affect the useful life of equipment include:

- Usage patterns

- Maintenance and repair practices

- Technological advancements

- Environmental conditions

3. Calculate Depreciable Cost

Depreciable cost is the portion of the equipment’s acquisition cost that can be depreciated over its useful life. It is calculated by subtracting the estimated salvage value of the equipment from its acquisition cost.

The formula for calculating depreciable cost is:

Depreciable cost = Acquisition cost

Estimated salvage value

Depreciable cost is different from acquisition cost in that it only includes the portion of the equipment’s cost that is expected to be used up over its useful life. The estimated salvage value represents the value of the equipment at the end of its useful life.

4. Methods for Calculating Depreciation

Depreciation is the process of allocating the depreciable cost of an equipment over its useful life. There are two main methods for calculating depreciation:

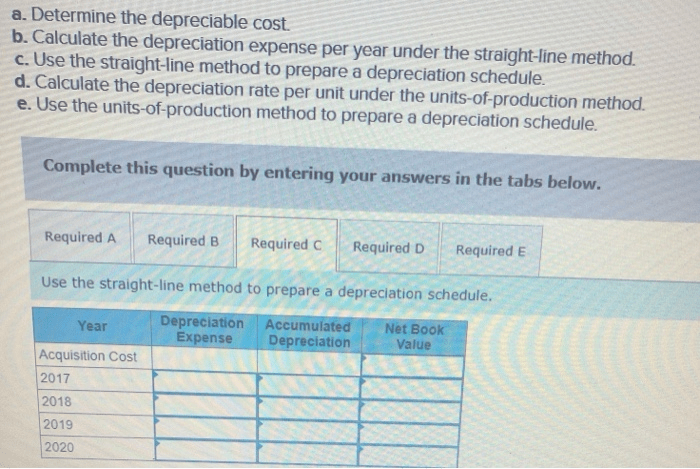

Straight-line method

The straight-line method allocates the depreciable cost evenly over the equipment’s useful life. The annual depreciation expense is calculated by dividing the depreciable cost by the useful life.

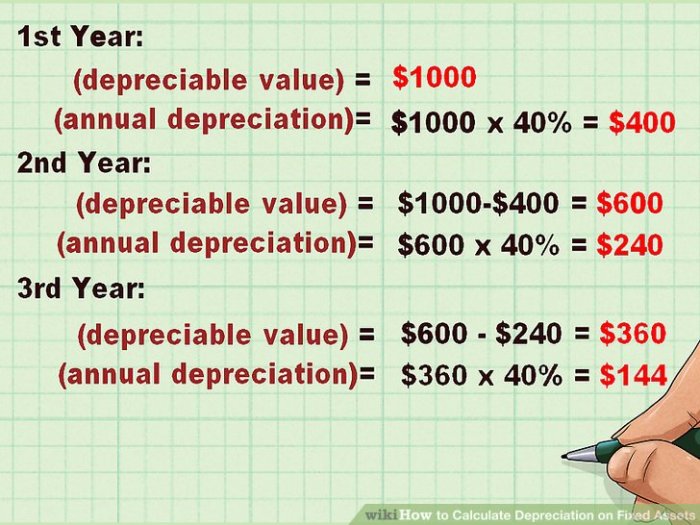

Declining-balance method, Calculate the depreciable cost of the equipment on january 1

The declining-balance method allocates a larger portion of the depreciable cost to the earlier years of the equipment’s useful life. The annual depreciation expense is calculated by multiplying the book value of the equipment by a fixed depreciation rate.

The following table compares the two depreciation methods:

| Method | Annual Depreciation Expense |

|---|---|

| Straight-line method | Depreciable cost / Useful life |

| Declining-balance method | Book value

|

5. Depreciate the Equipment’s Cost: Calculate The Depreciable Cost Of The Equipment On January 1

To calculate depreciation expense for the first year using the straight-line method, divide the depreciable cost by the useful life. For example, if the depreciable cost is $10,000 and the useful life is 5 years, the first year’s depreciation expense would be $2,000.

A depreciation schedule is a table that shows the depreciation expense for each year of the equipment’s useful life. The following is an example of a depreciation schedule for the equipment with a depreciable cost of $10,000 and a useful life of 5 years, using the straight-line method:

| Year | Beginning Book Value | Depreciation Expense | Ending Book Value |

|---|---|---|---|

| 1 | $10,000 | $2,000 | $8,000 |

| 2 | $8,000 | $2,000 | $6,000 |

| 3 | $6,000 | $2,000 | $4,000 |

| 4 | $4,000 | $2,000 | $2,000 |

| 5 | $2,000 | $2,000 | $0 |

Depreciation has a significant impact on financial statements. It reduces the book value of the equipment, which in turn affects the calculation of profit or loss and the balance sheet.

Answers to Common Questions

What is the difference between acquisition cost and depreciable cost?

Acquisition cost is the total cost of acquiring an asset, including purchase price, sales tax, and installation expenses. Depreciable cost is the portion of the acquisition cost that can be expensed over the asset’s useful life.

How do I determine the useful life of equipment?

The useful life of equipment can be estimated based on industry standards, manufacturer’s specifications, and historical usage data. Factors such as expected usage, technological advancements, and maintenance schedules should be considered.